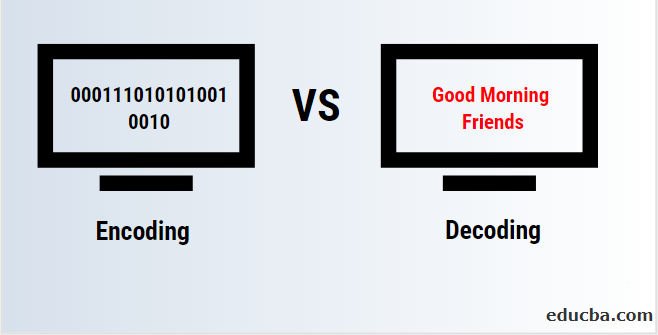

Capital City Bank vs Capital One: Decoding the Essential Differences That Shape Your Financial Choice

Capital City Bank vs Capital One: Decoding the Essential Differences That Shape Your Financial Choice

In a financial landscape saturated with banking options, the battle between Capital City Bank and Capital One stands out as a compelling case study in institutional DNA—two divergent models serving distinct customer priorities. While both promise reliability and innovation, their core strategies, customer experiences, and product philosophies reveal fundamental differences that can decisively influence where your money belongs. Capital City Bank, often rooted in community-focused service, contrasts sharply with Capital One’s tech-driven, nationwide approach.

Understanding these contrasts is essential for consumers navigating today’s increasingly complex banking ecosystem.

At the heart of the divide lies **customer orientation**: one emphasizes personal, community-based relationships, while the other champions digital-first convenience. Capital City Bank, typically smaller in footprint, focuses on building long-term relationships with its members, offering localized support that extends beyond transactions—personalized financial counseling, credit education, and responsive branch service are hallmarks.

Capital One, by contrast, operates as a national fintech powerhouse, leveraging

Related Post

What Do I Need to Change My Last Name? Navigating the Process with Clarity and Confidence

The Untold Truth of Joe Wilkinson’s Wife: Unveiling the Quiet Strength Behind the Public Figure

Teach Me First Manga for Free: Unlock Global Storytelling Without Paying a Penny

Are Benicio And Guillermo Brothers? Uncovering the Truth Behind the Dominican Star Duo